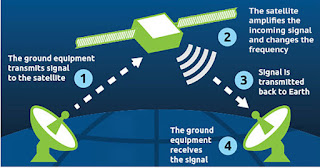

Note 1: If you don´t know anything about communication satellites, I

would recommend to read this link communication-satellites-101 before you go ahead.

Overview

With a fleet of 9 Ku-FSS, Ka-FSS and S-MSS, EchoStar (SATS) provides video distribution, data communications, and backhaul services to meet the needs of media and broadcast organizations, enterprise customers, and US government service providers.

Headquartered in Englewood, Colo., and

conducting business around the globe, EchoStar operates two business segments:

Hughes Network Systems and EchoStar Satellite Services (ESS).

According to the last Q3 of 2019,

dated at Sep 30th, EchoStar had $1,841.1m of revenues, $-1.6m of EBIT and total

assets for $7,037.8m.

As of Nov 21th, 2019, EchoStar´s market

capitalization was $3.9B with 97.4 million shares outstanding at a value of

$40.68 each.

History

EchoStar was founded in 1980 by

Charles Ergen with $500k in savings, as a distributor of C band TV systems.

In 1995, the firm launched its first

satellite, EchoStar I. In 1996, it established the DISH Network business to

market its home satellite TV system.

In 2008 DISH Network was spun-off,

so EchoStar and DISH Network operate as separate public companies. However, a

substantial majority of the voting power of the shares of both companies is

owned beneficially by Charles Ergen.

As of Nov 21th, 2019, DISH Network and

EchoStar, had a market capitalization of $20B and Charlie has a net worth of ~$10B

Business Segments

EchoStar has two important businesses,

adding a third “Corporate&Other” not classified in the other two.

1.Hughes Segment

Hughes is the global leader in

satellite broadband for home and office, delivering solutions and a

comprehensive suite of managed services for enterprises and governments

worldwide. Two kinds of customers, two businesses within Hughes, ie: Consumer

and Enterprise.

Hughes is supported by a fleet of 5

Ka-band satellites: Jupiter1, Jupiter2, Eutelsat 65, Telesat T19V and SPACEWAY

3.

2.EchoStar Satellite Service

ESS consists of 2 Ku/Ka satellites

which provide video distribution, data communications and backhaul services to

meet the needs of media and broadcast organizations, enterprise customers and

government service providers.

Hughes Segment Business and Jupiter Satellites

This segment is supported by two

fundamental satellites: Jupiter1 and Jupiter2. What are Jupiter Satellites? and

what can we expect from them?

Over the past several years, a

technology shift has occurred within the satellite industry; as an example: Ka-Band

EchoStar XIX/Jupiter2, launched in 2016, offer 200x capacity compared to legacy

Ku-Band satellites, with in-orbit cost per Gigabyte per Second (Gbps) only a

fraction of older satellites and confirming Moore´s Law.

The number of satellites that can

offer this sort of service is also limited by the number of orbital slots

available and the IP is very hard to recreate. In fact, only two companies fit:

EchoStar and Viasat (VSAT), leaving us with a duopoly market.

Hughes Consumer Business

Consumer Business sells broadband

service to consumers in very rural/underserved areas.

In the last years, Hughes Satellites has

increased its capacity (Gbps) and the Hughes Consumer Business has increased

its number of subscribers, going from 626,000 subscribers and 10Gbps in 2011 to

1,437,000 subscribers and 370Gbps in 30Sep2019. In the next table you can see

this significance evolution.

The cost to build out infrastructure

to underserved households in US is very expensive for cable, DSL or fiber

companies. The Federal Communications Commission (FCC) estimated the cost to

deliver broadband to the 10-20m households in extremely remote areas at approximately

$8-10k per home. A cable company receiving $65/month in broadband revenue ($780/year)

on a average life of four years for a customer and a 18% EBIT margin, spending

$8-10k to receive a total present value of $8,229k in cash flows over the life

of a subscriber, do not seems a good business.

On the other hand, if EchoStar

spends $450m to build a satellite that can service 1m susbcribers who are

willing to pay for higher speeds (25mbps) vs dial-up/DSL (1-5mbps), their cost

to build out to a home is about $500 (including some cost of the modem at the

customer´s home), constituting favorable economics.

EchoStar and competitors Viasat´s

combined 4 satellites can serve 4m customers while the Federal Communications

Commission (FCC) estimates that market size is about 20m unserved/underserved

households in the US alone.

Finally, two more potential areas that

will be satisfied by Ka-Band Jupiter Satellites are: 5G Wireless and Inflight

Broadband Speeds.

5G Wireless is an ultrafast wireless

standard that requires a densified network – ie more wireless towers along with

small cell wireless towers attached to lampposts and in buildings. 5G is also

all about backhaul –when we densify wireless networks with so many more radios,

we need to “trunk” that data back through to the data centers. Trunking is

accomplished through fiber/cable in large cities and satellite in rural areas. Given

their cost per bit advantage in Ka-Band, we could envision an entire fleet of

Echostar satellites across the world trunking capacity in rural areas.

In-flight broadband speeds using

Ka-Band are much faster than substitute products that use Ku-Band. This is a large

and growing market as new satellites are built across regions with aircraft

traffic.

What can I expect from this business

in the next years? We can start by the last data of susbcribers reported which is

1.437 millions, and I have estimated an average annual revenue per user $780, this

give me a revenue of $1,121 millions in Hughes Consumer Business.

I will assume an expected growth

equal the current expected inflation of 1.54% (nominal interest rate minus

TIPS) for revenues per subscriber. Moreover, I will expect 2.735 millions

subscribers around year 3 according capacity of satellites, and stay at this

level forever.

I should advise that I have not

consider any other satellite in the next years, but this is wrong as Echostar

plans to launch Jupiter3 in 2020 adding more capacity and revenues.

Hughes Enterprise Business

Echostar provides of managed network

services for large blue chip and medium/small enterprises across a range of

industries (Lottery, Retail, Hospitallity, Restaurant, Finance/banking,

Oil&gas, Airbone broadband, etc).

Enterprise Business offer

connectivity to business in remote areas (ie all Getty stations outside

cable/DSL footprint for transaction connectivity) utilizing Hughes´s

aforementioned satellite constellations. Similar to the Consumer Business, with

customers in rural areas, this business has little completion and 99% customer

renewal.

In addition, the Enterprise Business

supplies of satellite ground infrastructure and terminals to operators

(Telefonica, Vodacom, IntelSat, EutelSat, GlobalStar, YahSat, BSNL, SES,

OneWeb, etc).

Same question again as consumer

business: what future for enterprise business? We know that Total Hughes

Revenues has been $1,806 millions and resting the amount of $1,121 millions of

Hughes Consumer Revenues, give us $685 millions for Hughes Enterprise Revenues.

I will be very conservative with the

future of these revenues and I will assume a growth in perpetuity of 1.69%

(Risk Free Rate in usd = 10Yr bond usd).

Valuing Operating Assets of Hughes

Business

Following in the next table I

summarize a probable future for the Hughes Segment and operating income in the

next 10 yrs.

I have estimated a current EBIT of

$88.15 millions (previously adjusted to R&D expenses and operating leses, and

after allocated corporate expenses) giving a margin of 4.88%, which I will scale

up to the global industry average of 14.96% plus a 5% premium (19.96%) in year

5 and stay forever at that level assuming Echostar will share the duopoly with

Viasat thanks to its economy of scale.

Tax rate will scale up to the Marginal

Tax Rate in year 10.

I will assume a high capital

investment model with low S/C Ratio. Although current S/C ratio is 0.49, I will

assume that the company will improve progressively up to the global industry

average of 0.99 in year 10.

The company had $797 in NOLs at

30dic18, and that amount must be taken in account in valuation.

Current cost of capital is 9.32%,

and will move towards the global industry average of 6.38% in year 10.

Finally I obtain a value operating

assets about $4,589 millions.

The European Spectrum Business, two probable scenarios

Echostar acquired Solaris in 2013

for $21.8 millions.

Solaris is a satellite company with

30MHZ of S-band spectrum in Europe and a satellite orbital slot. Echostar could

lease the spectrum to wireless carrier and sell satellite service (machine to

machine for logistics management, satellite radio service.. etc).

Users of smartphones are consuming

more bandwidth each year, straining the medium by which the bandwidth is

transmitted, spectrum. As wireless operators scramble to offer higher speeds to

consumers, the value of spectrum will continue to increase.

Echostar is in discussions with

regulators across the EU to repurpose this spectrum for terrestrial use.

Thus, it is probable one of these

scenarios:

Scenario1

Let´s suppose that Echostar receive full approval

from all EU regulators to run a Wholesale LTE Network.

I will consider this scenario as an

option to expand an investment in new markets, to take advantage of favorable

conditions.

Above I detail the inputs to

estimate the value of the option ($1,599 millions) using a Black-Schole model.

Scenario2

If Echostar does not receive full approval from

all EU regulator, the company could launch some combination of a satellite

radio network with a wireless network.

Using the same method as the Scenario1,

I value the option in $913 millions.

Investment in Dish Mexico

Echostar owns 49% of Dish Mexico, an

entity that provides direct-to-home satellite services in Mexico. While

financials are undisclosed, Dish Mexico has grown its subscriber base at

40%+/year and is estimated to have about 5m subs, currently.

While DBS providers in the US and in

other developed nations trade at about $400-600/ subscriber, ARPUs are about

50% lower in Mexico, thus we value the investment in Dish Mexico at $613

millions.

Tying the pieces that I understand

Probably there are more hidden value

in Echostar, for example: what about other minority investments, or what future

could we expect in the ESS segment,.. there are other examples, but my capacity

to discover other value is limited and I have decided to concentrate my efforts

in what I know: Hughes Segment with subscribers in consumer front, Hughes

Segment in enterprise front, the investment in Dish Mexico and the two options/scenarios

of the spectrum in Europe.

Attaching

all these three values, I finally arrive at $69.80 value/share for scenario.1

and $62.77 value/share for a worst scenario.2